Also in this series:

- Is it Time to Launch that New Academic Program? The Art and Science of Answering that Question

- Feasibility Checklist: The Science of Bringing New Academic Programs to Life

Developing a 4-Year Financial Proforma

In my previous article, Feasibility Checklist: The Science Behind Bringing New Academic Programs to Life, I discussed the importance of cultivating a discipline around process and metrics to new academic program development and success. Gaining a clear and accurate sense as to what it will take to launch and sustain your new program before you enroll your first student is a critical prerequisite and a helpful exercise for surfacing and testing important assumptions.

At Bay Path University, all new academic program proposals must include a four-year financial proforma, which is typically developed jointly by the dean, the chief financial officer, and the provost. Through this process, we invariably surface financial assumptions, strategies and program operational plans or outcomes that when checked more thoroughly prove to be unworkable or in need of revision.

For example, in developing a new graduate program a few years ago we discovered that our “creative” approach to structuring the curriculum was not financially viable without some major tweaking.

The financial proforma serves many useful purposes – the most important of which is estimating the program’s net financial contribution and impact. If sufficiently robust, the proforma enables you to think systematically about what will be required (both short and long term) to ensure the program’s success. The proforma also helps you think through upfront variables such as pricing and marketing expenses to consider how much risk you are willing to assume for factors that are often outside of your control due to the competitive context in which your program resides.

At my institution, an important financial principle undergirding all new graduate program development is this: At a minimum, a new program needs to be able to support itself while also contributing resources back to the institution. Specifically:

- By “support itself,” we mean that the program’s revenue contributions must offset and ideally outpace the expenses required for operation.

- The extent of net contribution expected by a new program and the timeline for meeting financial projections is determined by considering the program’s importance to the institutional mission and the institution’s projected long-term financial equilibrium.

For example, we may be willing to assume a greater upfront resource investment and a longer break-even timeline for a program that will contribute significantly over time. Or we may be willing to consider a more modest and perhaps even ‘break-even’ net contribution for a program that contributes to our mission in a significant way. Obviously, you must also consider the contribution of each program against the whole to ensure a balance that enables the institution to maintain its financial equilibrium.

A second important principle for new program proformas involves the timeframe for your financial projections. From my experience, a minimum of three years is necessary for capturing the full range of variables that may potentially impact the program’s financial potential.

In developing a financial proforma for a new academic program, there are four primary components that are included in the template that we use. I describe each component below, using data to illustrate what each of these components is comprised of.

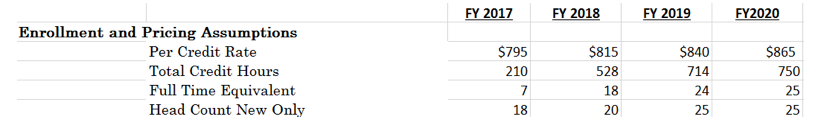

1. Enrollment and Pricing Assumptions

Tuition pricing, as in the per credit rate (see Chart A), for individual programs is informed by the competitor analysis that we complete as part of the feasibility study. Specifically, we research the primary competitors within the geographic reach of the program’s market taking into account discounts, scholarships and other pricing differences by program. We also consider the difficulty of entering the market and the extent of competition. Our initial tuition price point typically reflects our best thinking about the minimum tuition price needed to obtain a break-even position for the program as quickly as possible.

Chart A

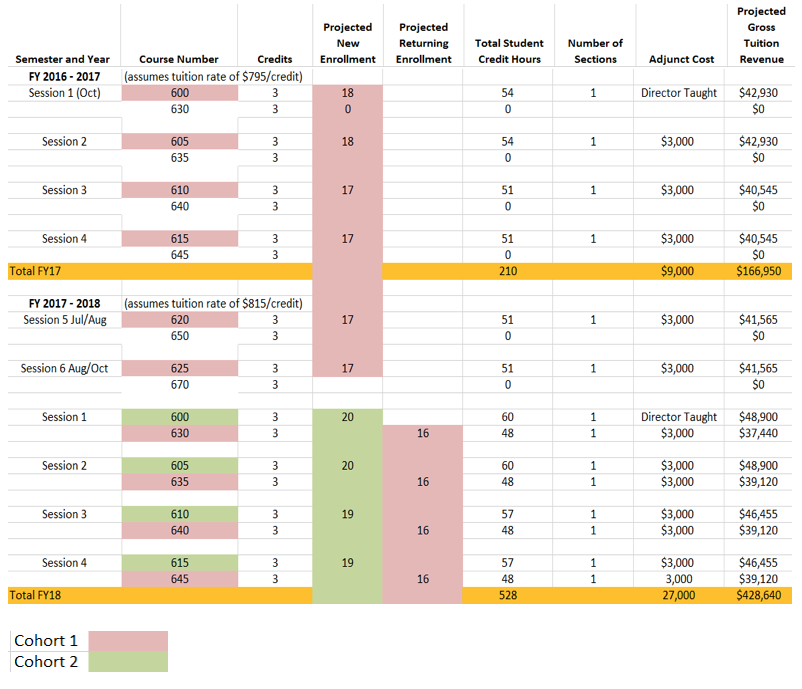

Total credit hours is a calculation that sums the total credits projected to be taken by each student in a given year. Chart B illustrates the template that we use to project student enrollment per term and the total student credit hours for years one and two of the proforma. The total student credit hours estimated is obtained by multiplying the number of credits for each course by the projected head count enrollment and then summing the totals for all terms.

Chart B

Click to see a larger version.

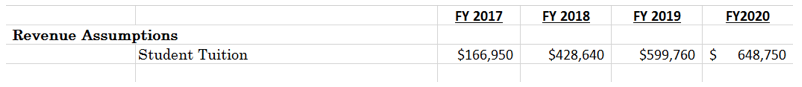

2. Revenue Assumptions

Revenue assumptions are obtained by calculating gross tuition revenue for each year of the proforma in addition to estimating all other possible sources of revenue. For example, in FY 17, we have projected a total of $166,950 in student tuition revenue. This is calculated by mapping out the course flow for this year, multiplying the total student credit hours by the per credit tuition charge and summing the totals for all terms. Other sources of revenue might include income generated from student fees that are specific to this program, non-credit offerings or other activities of the program.

Chart C

Click to see a larger version.

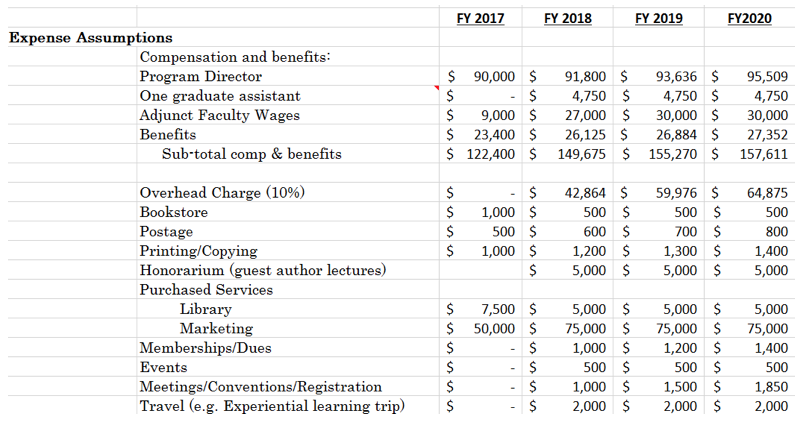

3. Expense Assumptions

Chart D illustrates the wide ranging expenses which must be captured in the proforma. The most significant expense is typically compensation and benefits which include the faculty (part-time and adjunct) cost by term and year in addition to other required staffing. Chart B shows our method for projecting faculty staffing needs and costs on a term by term basis. In the case of programs that carry external professional accreditation, it is important to know and factor in accrediting agency’s minimum staffing requirements. These commonly are tied to program enrollment and will need to be adjusted accordingly.

At Bay Path, we assess a 10% overhead charge for each new revenue-producing program, typically beginning in year two. This allows us to account for the institutional infrastructure costs that are incurred as enrollments grow but can be difficult to isolate. These funds are pooled and then used to fund new hires or pay for items that are needed to strengthen the institution’s capacity to support more students.

An additional critical expense includes marketing costs which are determined according to the program’s competitive context and geographic reach. For example, we will project higher marketing costs for a new program that will be offered entirely online and for which the reach is national or international versus an on campus program that has a local reach.

Finally, it is important to consider whether the program will incur any capital expenditures (such as a build-out of existing space or equipment) as well as whether there are any accrediting or other regulatory costs associated with the program.

Chart D

Click to see a larger version.

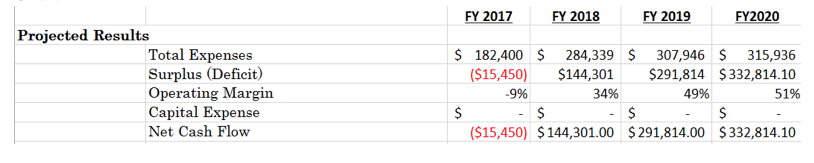

4. Projected Results

Chart E ties the components together with an estimate for the program’s net cash flow. This is calculated by subtracting the total expenses (Chart D) from the total revenues (Chart C) and subtracting any capital expense (if relevant). Unless there are compelling extenuating circumstances, we aim for a positive net cash flow for all new programs by year two. We also calculate the operating margin for each new program and aim for a margin of at least 25% by year two. The operating margin is calculated as follows: surplus/deficit divided by total revenues. A program that is able to sustain an operating margin of at least 50% by year four is considered to be a strong net financial contributor.

Chart E

Click to see a larger version.

Conducting feasibility studies and developing financial proformas for our new academic programs has been key to Bay Path University’s endeavors in launching more than 20 successful new graduate programs over the past decade. Consider adopting and adapting these processes at your own institution.